Transform your Financial Future

with our Expertise

Our seasoned experts, who have been practitioners in their fields, bring years of experience in cash flow management, working capital optimization, and AI-driven financial strategies to help your business thrive.

Explore Our Services

Cash Forecasting

Accelerate your cash flow optimization with our expertise in cash forecasting. We deliver tailored strategies and actionable insights to ensure your business stays ahead in today's dynamic financial landscape.

- Accurate cash flow forecasting models

- Scenario planning and stress testing

- Proactive liquidity management

Working Capital Optimization

Optimize working capital management by streamlining processes and unlocking hidden value within your receivables and payables. Our strategies help enhance liquidity and improve cash conversion cycles.

- Unlock cash through sustainable process changes

- Improve cash flow with advanced analytics

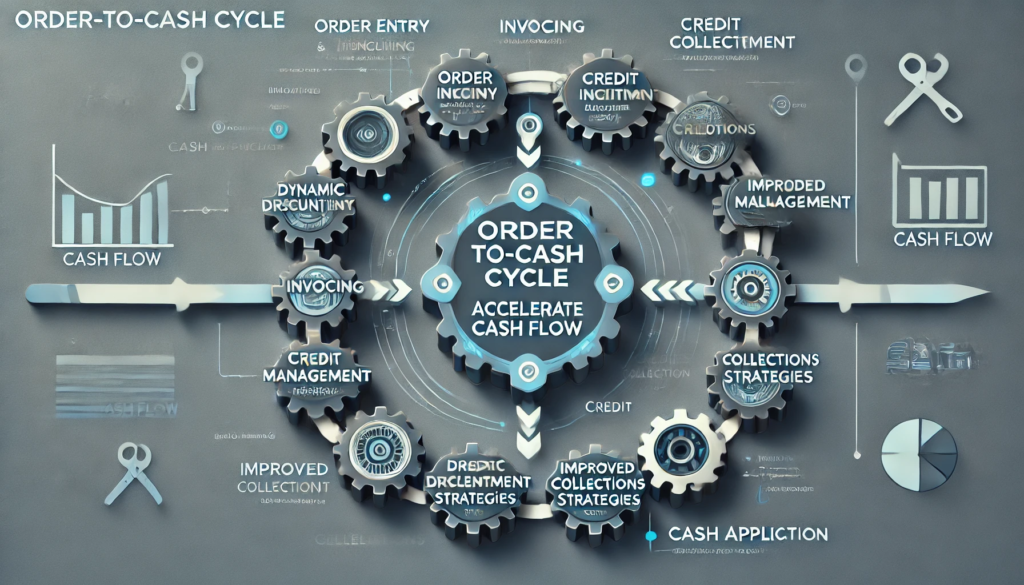

Receivable Financing and Monetization

Unlock the full value of your receivables and optimize working capital through factoring, securitization, and dynamic discounting. Empower your business to accelerate cash flow, enhance liquidity, and seize growth opportunities.

- Streamline Order-to-Cash process

- Leverage Customer Payment Behavior Analytics

- Implement Factoring and A/R Financing

Payment Processing Optimization

Accelerate your payment processes, eliminate manual errors, and improve cash flow visibility. We help streamline your accounts payable processes, reduce costs, enhance vendor relationships, and increase efficiency.

- Implementation of automated payment systems

- E-payables solutions and vendor management

- Security enhancements and compliance adherence

Expense & Credit Card Management

Maximize profitability by minimizing fees and optimizing interchange rates, while also streamlining your expense management processes. We help you manage purchasing cards (P-Cards) and employee expenses, ensuring efficient tracking, control, and reporting.

- Fee negotiation and interchange optimization

- Implementing efficient credit card and expense management processes

- Enhancing visibility and control over P-Card and employee expenses

Bank Account and

Fee Optimization

Unlock significant cost savings by leveraging advanced analytics to identify inefficiencies and negotiate better banking terms. We assist in rationalizing your bank accounts to streamline operations and reduce costs.

- Bank account rationalization and consolidation

- Ongoing monitoring of banking costs

- Detailed bank fee analysis and negotiation

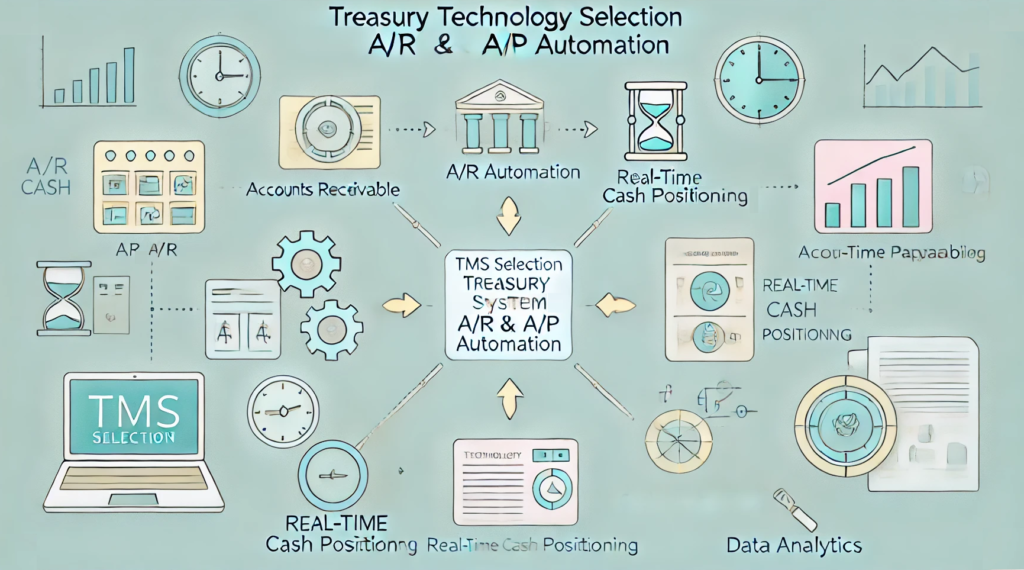

Treasury, A/P & A/R Technology Selection

Elevate your treasury operations with our insights into selecting and implementing best-in-class treasury technology solutions. We guide you in automating processes, gaining real-time visibility, and optimizing cash management, while seamlessly integrating A/R and A/P for comprehensive financial management.

- Treasury management system (TMS) evaluation and selection

- Automation of treasury, A/R, and A/P tasks for efficiency

- Real-time cash positioning and data analytics

Debt Mgmt. and

FX & IR Hedging

Optimize your debt structure, reduce financing costs, and protect against foreign exchange and Interest Rate risk with our expert guidance. We assist in debt issuance, refinancing, and implementing effective FX & IR hedging strategies to ensure financial stability.

- Debt portfolio analysis and restructuring

- Development of FX & IR hedging policies and implementation

- Risk mitigation for foreign exchange exposure